Not known Details About Stonewell Bookkeeping

8 Easy Facts About Stonewell Bookkeeping Shown

Table of ContentsThe Stonewell Bookkeeping IdeasAll about Stonewell Bookkeeping6 Simple Techniques For Stonewell BookkeepingStonewell Bookkeeping for BeginnersGet This Report on Stonewell Bookkeeping

Below, we answer the question, how does accounting assist a service? In a sense, bookkeeping publications represent a picture in time, but just if they are upgraded usually.

None of these conclusions are made in a vacuum cleaner as valid numeric info must strengthen the monetary choices of every tiny company. Such information is assembled with accounting.

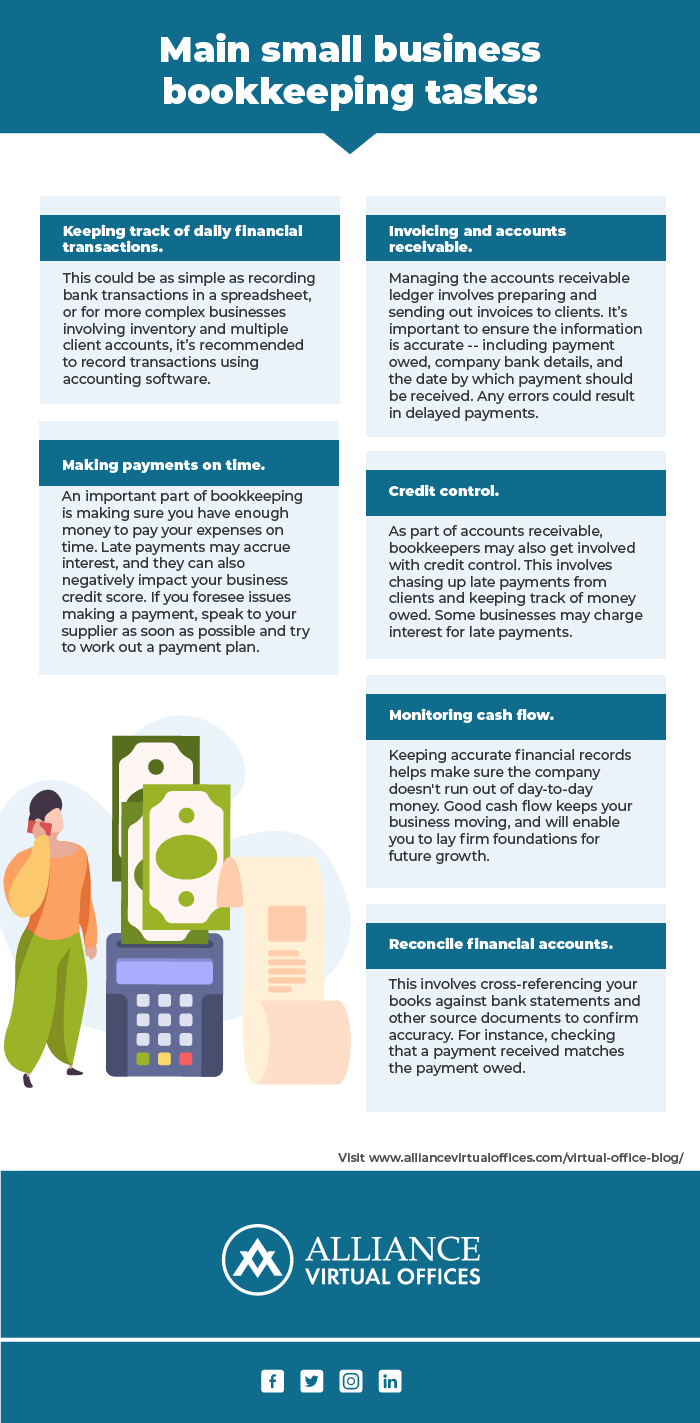

Still, with appropriate capital management, when your publications and journals depend on day and systematized, there are far less enigma over which to fret. You recognize the funds that are readily available and where they fail. The news is not constantly good, yet at the very least you know it.

The Best Guide To Stonewell Bookkeeping

The labyrinth of reductions, credit scores, exceptions, schedules, and, certainly, fines, is enough to simply give up to the internal revenue service, without a body of efficient documents to sustain your cases. This is why a devoted bookkeeper is very useful to a small company and deserves his or her king's ransom.

Those charitable payments are all identified and accompanied by details on the charity and its repayment details. Having this details in order and close at hand allows you file your income tax return with ease. Remember, the federal government doesn't fool around when it's time to submit tax obligations. To make sure, a business can do whatever right and still undergo an internal revenue service audit, as many already recognize.

Your company return makes cases and representations and the audit focuses on verifying them (https://johnnylist.org/Stonewell-Bookkeeping_320527.html). Good bookkeeping directory is all concerning connecting the dots between those representations and truth (business tax filing services). When auditors can comply with the info on a journal to invoices, financial institution declarations, and pay stubs, to call a few files, they promptly learn of the competency and integrity of the company organization

The Best Guide To Stonewell Bookkeeping

Similarly, careless accounting includes in stress and anxiety and anxiety, it also blinds entrepreneur's to the potential they can understand over time. Without the info to see where you are, you are hard-pressed to set a location. Only with reasonable, comprehensive, and valid data can a company owner or management team story a training course for future success.

Company owner recognize ideal whether an accountant, accountant, or both, is the right solution. Both make essential payments to an organization, though they are not the very same occupation. Whereas a bookkeeper can gather and organize the information required to support tax prep work, an accountant is much better fit to prepare the return itself and really analyze the revenue declaration.

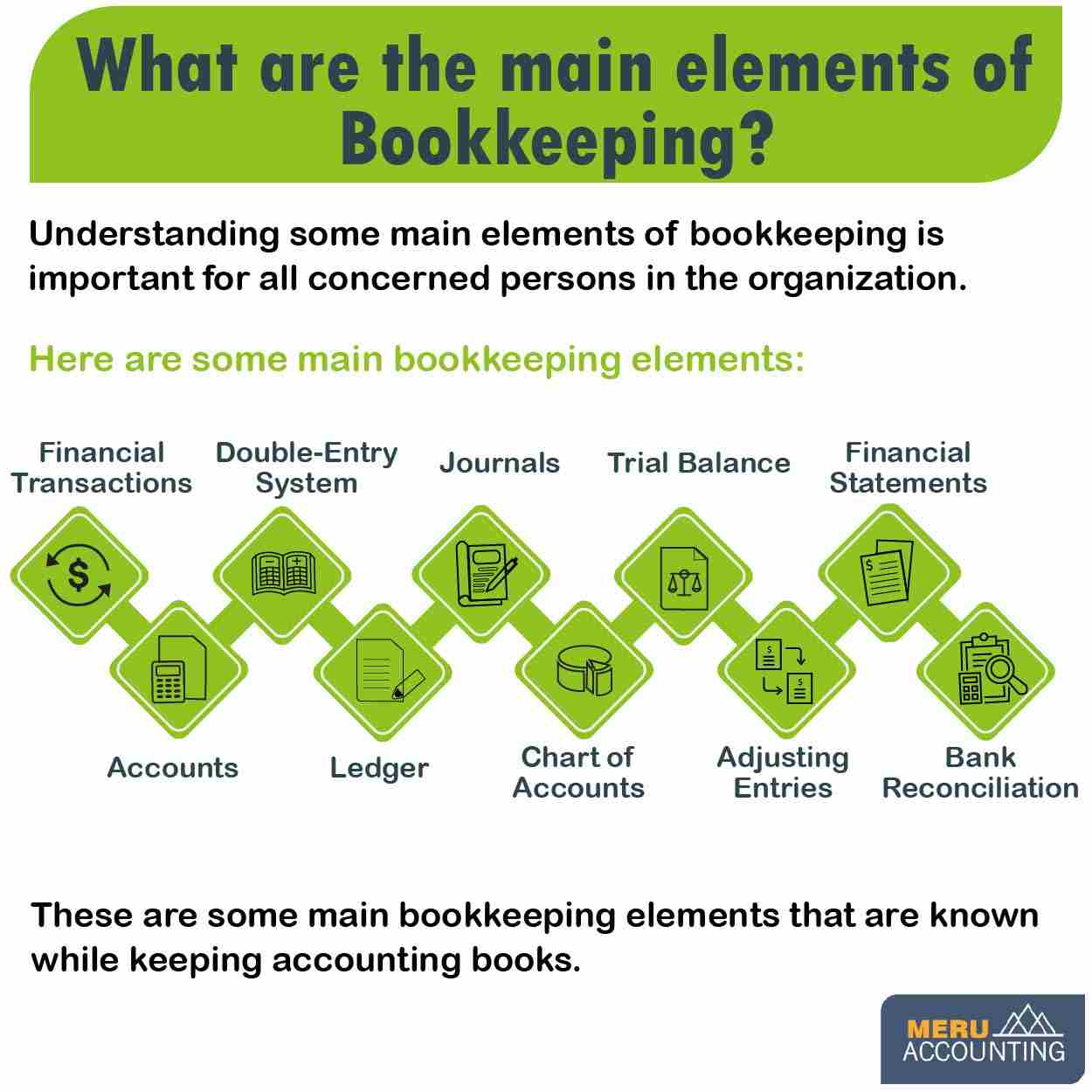

This article will certainly delve right into the, consisting of the and how it can profit your company. Accounting involves recording and arranging monetary deals, consisting of sales, acquisitions, repayments, and receipts.

By regularly updating financial records, accounting aids organizations. This helps in quickly r and saves companies from the stress and anxiety of searching for files during deadlines.

The 7-Minute Rule for Stonewell Bookkeeping

They are primarily concerned about whether their cash has actually been utilized appropriately or not. They absolutely need to know if the firm is making money or not. They additionally would like to know what possibility the business has. These aspects can be quickly managed with accounting. The profit and loss statement, which is prepared routinely, shows the revenues and also establishes the prospective based upon the earnings.

By keeping a close eye on economic records, businesses can set practical objectives and track their progress. Routine accounting guarantees that businesses stay compliant and avoid any kind of penalties or legal issues.

Single-entry bookkeeping is easy and functions ideal for small companies with couple of deals. It entails. This method can be compared to keeping a basic checkbook. It does not track possessions and obligations, making it less detailed contrasted to double-entry accounting. Double-entry accounting, on the other hand, is much more innovative and is usually thought about the.

Examine This Report about Stonewell Bookkeeping

This can be daily, weekly, or monthly, depending upon your service's size and the volume of purchases. Don't be reluctant to seek assistance from an accountant or bookkeeper if you locate handling your financial records testing. If you are searching for a complimentary walkthrough with the Bookkeeping Service by KPI, call us today.